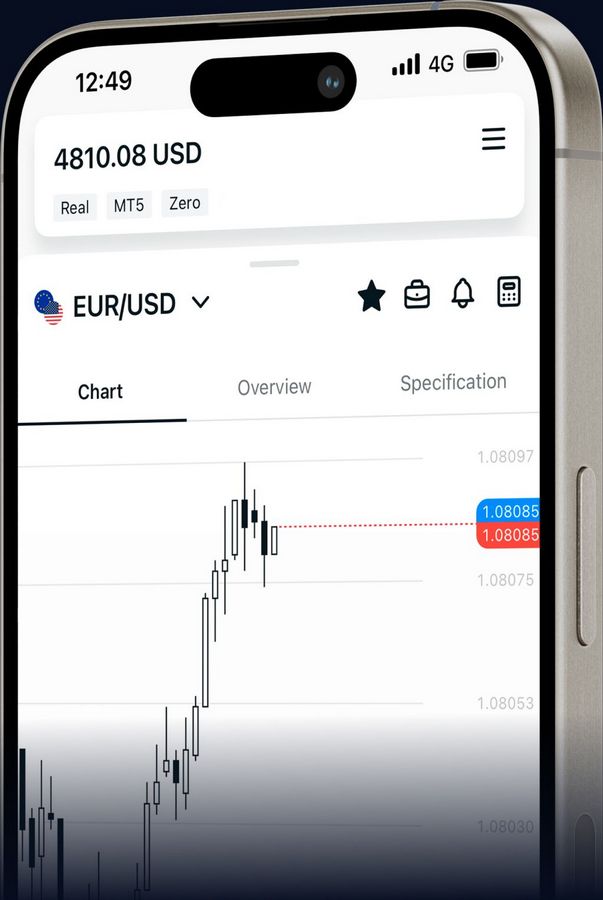

There are two approaches for how you can trade CFDs in this fashion at Exness: you can either make use of the MetaTrader system provided by Exness, or attach straight to the brokertrading system making use of an API(Application Programming User Interface).

- Mathematical trading automates trading choices utilizing computer programs based on a collection of fixed mathematical guidelines.

- One of the most common methods of using automated trading is via the MetaTrader platform or by linking an API to a brokertrading system. The advantages of automated trading consist of removing feelings from the procedure, speed, efficiency and threat management.

- You can use a device called Specialist Advisors for computerized trading on MetaTrader.

- To attach an API to the brokersystem, adhere to the directions found on the brokerwebsite. At BrokerChooser, we exclusively recommend suppliers controlled by top-tier authorities, contributing to the legitimacy of these brokers.

Read more Exness charts on TradingView At website Articles

Most notably, see to it you understand and understand the dangers of CFD trading and know exactly how to handle them. If you are certain in your understanding and have an audio trading and danger management technique, you can more comfortably handle the difficulties of trading CFDs at Exness.

What is automated (mathematical) trading?

Automated trading, likewise described as algorithmic (or algo) trading, entails using a computer program that adheres to mathematical instructions to instantly make trading decisions. These programs examine market developments and trends, for instance cost graphes, and use preset rules offered by the programmer to establish whether to acquire or market different properties on economic markets, based upon the algorithmguidelines. Once the predefined standards are satisfied, the computer system will certainly additionally leave the setting.

By removing emotions from the decision-making process, mathematical trading permits investors to convert precise concepts, such as the departure point and setting size, into an automatic system where the computer decides as opposed to the investor. This can help raise the reliance on logical strategies and minimize threat.

Investors can produce customized platforms by constructing an API using coding and connecting it to the trading systems of brokers that support API access. This makes it possible for efficient order placement, profession execution, and accessibility to real-time market information, supplying traders with the tools required to carry out algorithmic trading effectively.

What are the benefits of using algo trading for CFDs?

CFDs are high-risk instruments as a result of the use of leverage, which can multiply your profits but additionally amplify your possible losses. With automated trading, it is especially crucial to comprehend the threats included with trading CFDs.

Algorithmic trading, or algo trading, can offer several advantages when trading Contracts for Distinction (CFDs):

- Take feelings out of the formula: Algo trading gets rid of psychological and spontaneous decision-making from the trading process. As orders are refined automatically when you have actually set the fixed regulations, psychological variables such as worry or greed, which would otherwise influence hands-on trading choices, are decreased.

- Rate and effectiveness: Mathematical trading makes it possible for high-speed, automated, consistent execution of trades, no matter market problems or human biases. Algorithms can evaluate market problems, identify trading chances, and implement trades with marginal delay, possibly leading to faster order placement.

- Backtesting: Prior to really making use of the automated trading or the underlying formula, investors can assess their policies making use of the old data and maximize trading techniques. This permits the investors to lessen potential blunders.

- Diversity: With algo trading, you can use multiple techniques at the same time, diversifying your trading technique across different markets or CFD instruments.

- Danger management: Automated trading enables the application of threat management procedures like stop-loss orders, routing quits, or earnings targets. These can be immediately applied within the algorithm to help handle risk.

On the adverse side, automated trading systems likewise bring some disadvantages, several of which are the possibility of technological concerns and system failures; the need for human monitoring of the trading system; the intricacy of making an effective trading system; and over-optimization, where methods carry out well in screening but fall short to do in real-time market conditions.

How to use MetaTrader for automatic trading

MetaTrader is just one of the most popular and widely-used trading platforms. This system, which offers versions MetaTrader 4 (MT4) and MetaTrader 5 (MT5), has a solid attribute called Professional Advisors (EA) that enables individuals to execute automatic trading.

To trade financial markets using formulas on MetaTrader, you can establish an Expert Expert, which is basically a robot that immediately places trades for you and can additionally take care of setting sizes when putting orders.

Expert Advisors are programs or manuscripts written in MQL (MetaQuotes Language). Although coding expertise is not required to utilize some pre-built Specialist Advisors, if you want to create or customize Expert Advisors to fit your certain trading strategy, you will certainly require some competent coding skills.

See to it to inspect the brokerwebsite for more comprehensive directions on just how to make use of MetaTrader for automatic trading at Exness.

You can additionally check out our top broker referrals in our post on the best MetaTrader brokers.

Automated trading systems for CFD trading at Exness |